All Categories

Featured

Table of Contents

Like lots of various other crowdfunding sites, FNRP hosts an online webinar before each offer launch. In them, a business board goes through the offer details and solutions any type of questions to aid investors better comprehend the investment. From there, investors get accessibility to property performance records, lease updates, and other asset-specific info, including on mobile applications for Android and Apple.

The company also assists capitalists execute 1031 exchanges to postpone paying funding gains taxes. Customers can get in touch with FNRP through an on-line contact kind or a website-listed phone number. On its site, FNRP says it's distributed $100 million to investors considering that 2015, gaining a net IRR of 15%. It additionally mentions that it has over $2 billion in possessions under management.

Client solution is offered from 9 am 6 pm ET. EquityMultiple boasts a breadth of offerings among 167 distinct markets and 123 sponsor/operator companions. The firm has deployed over $570M in investor funding and $379M in overall distributions - Exclusive Real Estate Deals for Accredited Investors. EquityMultiple is a wonderful option for investors looking for accessibility to equity, preferred equity, and elderly financial obligation across many CRE residential or commercial property kinds.

Broadening its range, Yieldstreet has diversified right into multiple financial investment opportunities, encompassing funding for commercial and home transactions, business financings like vendor cash money advances, purchase of oil tankers, and investment in great art. Investors get rate of interest payments and the return of their major financial investment throughout the financing duration. Several possibilities have financial investment minimums in between $10,000 and $20,000, with target hold periods varying by offering.

How do I apply for Accredited Investor Rental Property Investments?

While the majority of investments are readily available only to approved capitalists, the Growth & Earnings REIT and the Yieldstreet Alternative Income Fund are likewise available to non-accredited investors, with both having a financial investment minimum of $10,000. The Yieldstreet Option Revenue Fund buys various alternate possession classes with a solitary financial investment, while the REIT provides accessibility to a diversified mix of real estate investments.

One special attribute of Yieldstreet is its Budget item, an FDIC-insured checking account that earns 3.25% yearly passion on funds held. Investors can pre-fund their account before spending, and the funds will be held within this interest-bearing monitoring account. The company website has a chatbot for asking FAQs or sending out messages, a get in touch with email address, and an Assistance.

Today, Yieldstreet has over 420,000 participants. These financiers have actually contributed greater than $3.9 billion to Yieldstreet offerings. Yieldstreet has a performance history of over $2.4 billion of complete bucks went back to investors, with 85% of offerings having accomplished within 0.5% of their target. Yieldstreet declares to be the largest system for personal market investing.

1031 Crowdfunding is an online market for industrial property investments specializing in 1031 exchanges, a popular resources gains tax obligation deferral technique. The system provides eye-catching tax obligation advantages for real estate investors. Established in 2014, 1031 Crowdfunding is an online industry for business realty financial investments concentrating on 1031 exchanges, a resources gains tax deferral technique.

Its site specifies the system has actually sold over $2.1 B in securities across even more than 1.5 K exchange deals. As of this writing, the platform also has more than 70 energetic financial investment opportunities noted. Unlike other crowdfunding systems that utilize LLCs, most 1031 Crowdfunding deals are housed within a Delaware Statutory Depend On (DST), which allows fractional possession in homes and the deferment of funding gains taxes after building sales.

The majority of deals are open to recognized financiers only. Some REITs and general genuine estate funds are open to non-accredited financiers. Registered users can log right into the online 1031 Crowdfunding website to track essential efficiency metrics and accessibility crucial investment papers such as property PPMs, tax viewpoints, economic projections, assessments, and finance details

What is a simple explanation of Residential Real Estate For Accredited Investors?

For help, users can submit a contact kind on the firm's web site or call the provided contact number. In general, 1031 Crowdfunding is a fantastic choice for investors who wish to lessen their tax obligation worry with 1031 exchanges and DSTs. There's no one-size-fits-all realty crowdfunding platform. The best option will certainly rely on the sorts of assets, investments, returns, and revenue regularity you desire.

Furthermore, actual estate crowdfunding is right here to state. According to Vantage Market Research Study, the global real estate crowdfunding market was valued at $11.5 billion in 2022 and is forecasted to reach a value of $161 billion by 2030, signing up a substance yearly growth price (CAGR) of 45.9% between 2023 and 2030.

We examined the type of investment, including residential or commercial property kind, holding durations, and withdrawal terms. We investigated exactly how very easy it is to track an investment's performance on the system.

These suggestions are based upon our direct experience with these companies and are suggested for their usefulness and efficiency. We encourage only acquiring items that you believe will certainly assist within your business purposes and investment goals. Nothing in this message must be considered as investment suggestions, either in support of a certain safety and security or relating to a general financial investment strategy, a recommendation, an offer to market, or a solicitation of or an offer to acquire any type of safety and security.

Accredited Investor Real Estate Investment Groups

For any type of concerns or assistance with these resources, do not hesitate to call. We're below to help!.

Genuine estate is an efficient and potentially rewarding way to expand an investment profile. It has also been generally unreachable for tiny financiers as a result of the large funding needs. The very best real estate financial investment apps have actually transformed that and opened brand-new chances. Dive to: Below are some apps that can assist you include genuine estate to your profile without excessive expenses.

The only downside is that you require to be accredited to accessibility the majority of the cooler stuff. Review extra $10,000 Development and Earnings REIT and YieldStreet Prism Fund; Varies for various other investments0 2.5% annual administration fees; Additional charges vary by investmentREITs, funds, realty, art, and other different investmentsVaries by financial investment DiversyFund provides daily financiers a chance to get a piece of the multifamily building pie.

You can still choose the traditional strategy if you want, however it's no more the only method to go. A variety of applications and solutions have emerged in current years that guarantee to democratize accessibility to real estate investing, offering also small-time financiers the chance to get into and profit off of large properties.

What types of Private Real Estate Deals For Accredited Investors investments are available?

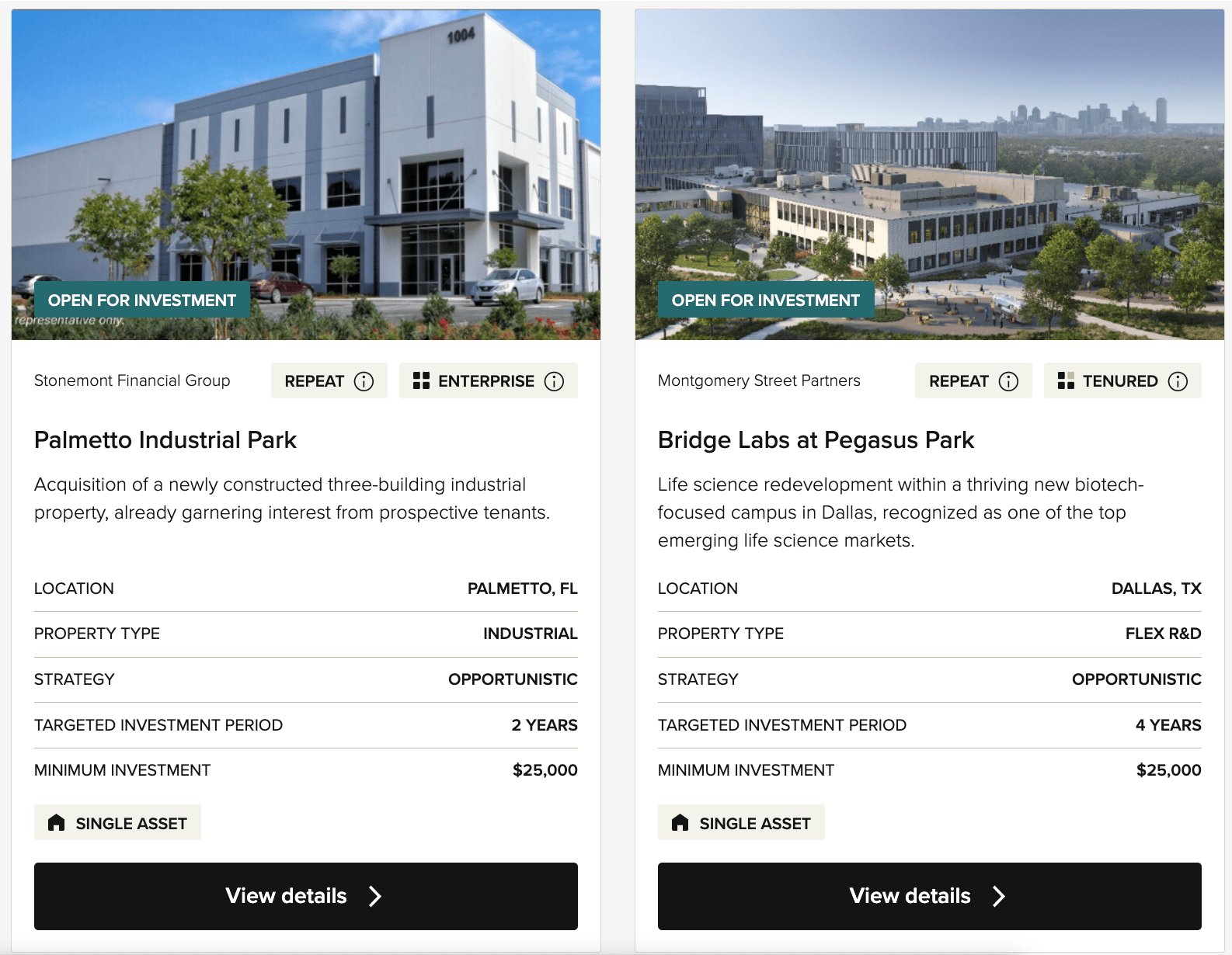

They act as a sort of commercial actual estate matchmaking service that attaches accredited financiers to sponsors looking for funding. There normally aren't that several offers readily available on their industry at any offered time (though this depends greatly on the total actual estate market), but in a means, that's kind of a great thing.

To put it simply, they aren't afraid to refuse offers that they don't think are great enough for their customers. The platform is cost-free, easy to use, and takes a lot of the migraine out of industrial genuine estate investing, it isn't best. There are two primary downsides: the fairly substantial minimal investment of $25,000 and the fact that it's restricted to recognized capitalists.

Table of Contents

Latest Posts

Delinquent Homes

Tax Foreclosure Overages

Delinquent Tax Auctions

More

Latest Posts

Delinquent Homes

Tax Foreclosure Overages

Delinquent Tax Auctions